Here’s the Top Four Credit Card Rewards for Q3 2021

While plenty of retailers have their own credit cards to earn a percentage back on a purchase or 0% interest for 6 to 12 months (along with astronomical interest rates if you don’t pay it off each month), many third party cards offer expanded options for rewards at your everyday retailers and other companies.

Here’s a collection of the top 5 cards you should be looking at as we move into the third quarter of 2021.

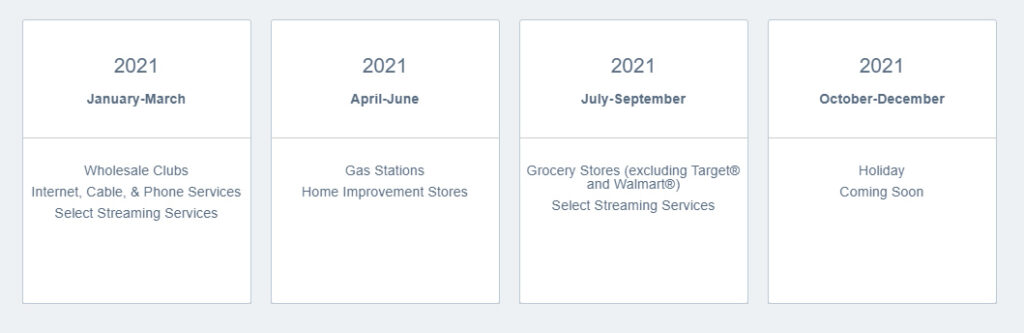

1. Chase Freedom

Between July 1, 2021 and September 30, 2021, the Chase Freedom card offers 5% back (up to $75 back on $1,500 in purchases) at grocery stores and select streaming services.

Beyond typical, grocery stores, this category does not include superstores like Target and Walmart that include grocery stores. It also doesn’t include warehouse clubs like CostCo & Sam’s Club as well as drugstores like Walgreens and CVS.

Streaming services included in the promotion are Disney+, Hulu, ESPN+, Netflix, Sling, Vudu, Fubo TV, Apple Music, SiriusXM, Pandora, Spotify and YouTube TV.

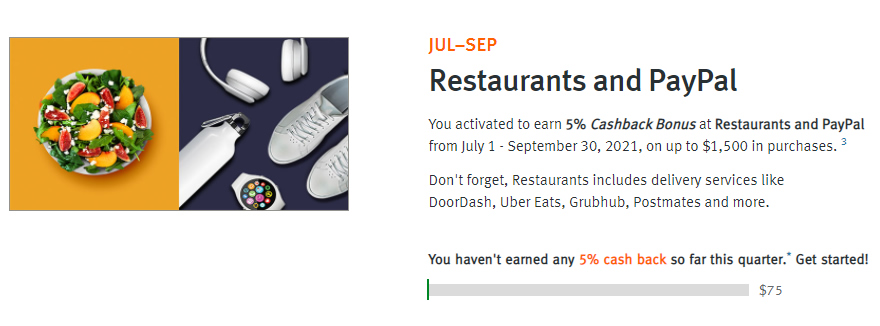

2. Discover it Cashback

Between July 1, 2021 and September 30, 2021, the Discover it Cashback card offers 5% back (up to $75 back on $1,500 in purchases) at restaurants and PayPal.

On restaurants, this promotion includes all full services restaurants, cafes, cafeterias and fast food locations. PayPal’s qualifying transactions include money transfers through the Friends and Family service as well as point-to-point transactions. It does not include the Xoom transfer service.

3. AMEX Blue Cash Preferred Card (Annual Fee Required)

Between January 1, 2021 and December 31, 2021, the American Express Blue Cash Preferred Card offers 6% Cash Back at U.S. supermarkets (up to $360 back on $6,000 in purchases) as well as 6% on streaming subscriptions & 3% on transit.

This card can be particularly useful for anyone with large families that spends quite a bit at the supermarket each month. It’s also good for the entire year (not specific to Q4), thus you can continue to save at the grocery store for 12 months.

The only downside is the $95 annual fee (waived for 1st year), but that’s easily mitigated with the $300 back on $3000 of purchases for new customers (first 6 months). If you don’t want the annual fee, you can step down to the Blue Cash Everyday card (which offers 3% back at grocery stores, same cap on total purchases).

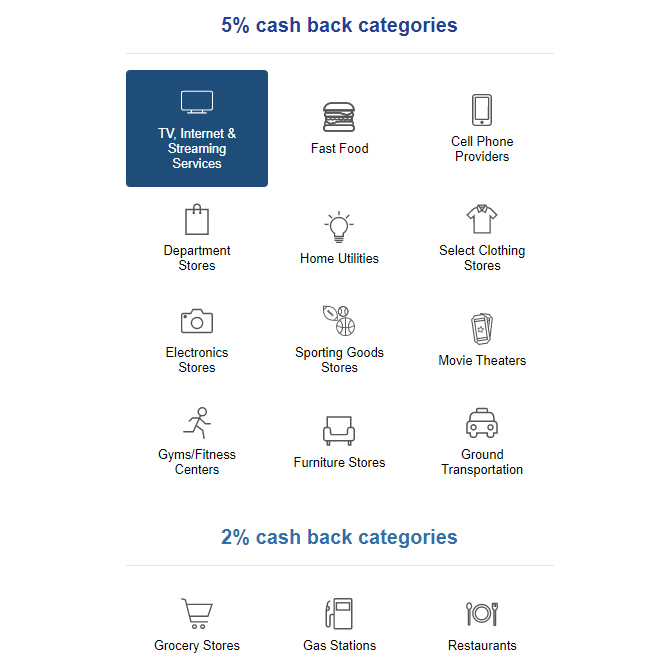

4. US Bank Cash Plus

The US Bank Cash Plus card is unique due to the fact that you can select the cashback categories that you want each quarter. After you sign up, you can select two different 5% cashback categories as well as one 2% cashback category.

For instance, if you know you want to buy a new couch soon, you can select the furniture store category to get 5% back on your purchase. Other 5% categories this quarter include electronics stores, utilities, gyms, department stores and fast food. The 2% categories include grocery stores, gas stations and restaurants.

Bonus: The Best Retailer Cards

As mentioned earlier, the best store cards are offered by Amazon and Target. Both retailers offer cards that offer 5% cashback without any cap on total purchases for the year. Popular cards include:

- Amazon Prime Rewards Visa Signature Card: 5% back on Whole Foods purchases, 2% back at restaurants / gas / drugstores, 1% back on everything else.

- Target RedCard: Free shipping on all Target.com purchases and additional 30 days for returning items. (Usually $40 off $40 coupon for signup)

- Lowe’s Advantage Card: Offers 5% cashback on all purchases. 6 months special financing on $299 or more purchases

- Costco Anywhere Visa Card: Offers 2% back on all Costco purchases, 4% back on gas, 3% back at restaurants