Here’s the Top Five Credit Card Rewards for Q4 2021

While plenty of retailers have their own credit cards to earn a percentage back on a purchase or 0% interest for 6 to 12 months (along with astronomical interest rates if you don’t pay it off each month), many third party cards offer expanded options for rewards at your everyday retailers and other companies.

Here’s a collection of the top 5 cards you should be looking at as we move into the third quarter of 2021.

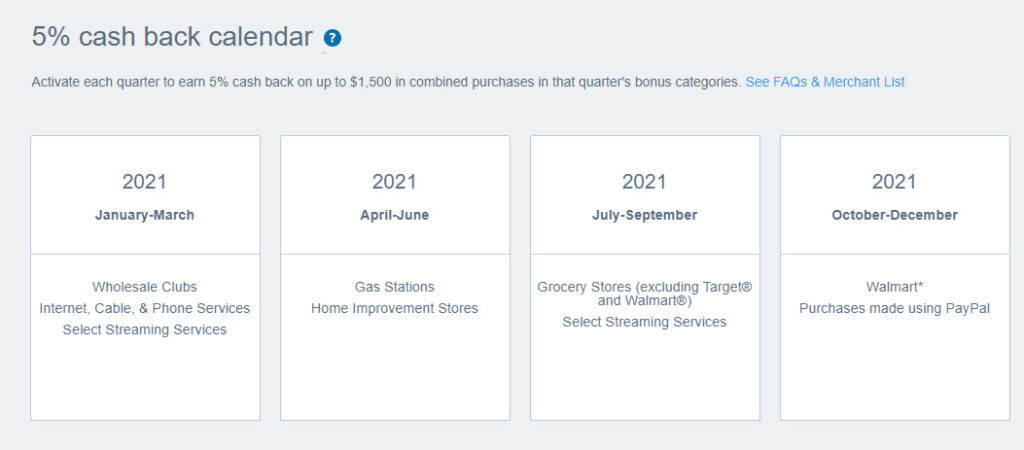

1. Chase Freedom

Between October 1, 2021 and December 31, 2021, the Chase Freedom card offers 5% back (up to $75 back on $1,500 in purchases) at Walmart and all purchases using PayPal.

The Walmart category appears to be specific to physical Walmart locations and not Walmart.com purchases. However, this likely means that all grocery purchases will quality at Walmart superstore locations or Walmart specific grocery stores.

Beyond normal purchases using PayPal at checkout, PayPal’s qualifying transactions include money transfers through the Friends and Family service as well as point-to-point transactions. It does not include the Xoom transfer service.

Outside of the 5% cashback categories, be aware that Chase lets you activate bonus offers that rotate out every couple weeks. These can be targeted at a specific dollar amount off or a percentage off. Some popular ones this month include $75 back from AT&T wireless, 15% back off purchases at Burger King and 15% off any purchases at JC Penney.

2. Discover it Cashback

Between October 1, 2021 and December 31, 2021, the Discover it Cashback card offers 5% back (up to $75 back on $1,500 in purchases) on all purchases at Amazon.com, Walmart.com and Target.com.

This includes all purchases on these sites or through the corresponding mobile apps. Regarding Amazon, this means you can earn 5% back on your Prime subscription, any digital purchase, or any purchase made at any physical location like Amazon Go, Amazon Bookstore, and Amazon 4-Star. It does not include purchases made at Whole Foods.

3. AMEX Blue Cash Preferred Card (Annual Fee Required)

Between January 1, 2021 and December 31, 2021, the American Express Blue Cash Preferred Card offers 6% Cash Back at U.S. supermarkets (up to $360 back on $6,000 in purchases) as well as 6% on streaming subscriptions & 3% on transit.

This card can be particularly useful for anyone with large families that spends quite a bit at the supermarket each month. It’s also good for the entire year (not specific to Q4), thus you can continue to save at the grocery store for 12 months.

The only downside is the $95 annual fee (waived for 1st year), but that’s easily mitigated with the $150 back on $3000 of purchases for new customers (first 6 months) as well as the $200 back on $1000 in Amazon purchases (first 6 months). If you don’t want the annual fee, you can step down to the Blue Cash Everyday card (which offers 3% back at grocery stores, same cap on total purchases).

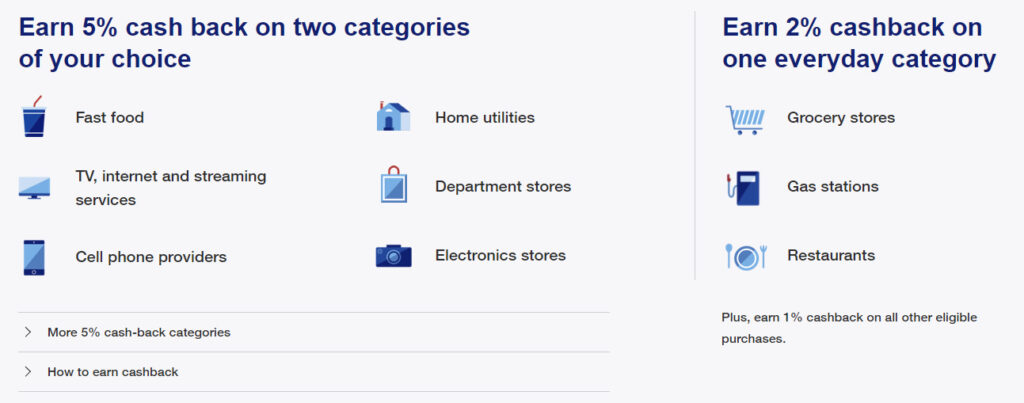

4. US Bank Cash+ Visa Card

The US Bank Cash Plus card is unique due to the fact that you can select the cashback categories that you want each quarter. After you sign up, you can select two different 5% cashback categories as well as one 2% cashback category.

For instance, if you know you want to buy a new couch soon, you can select the furniture store category to get 5% back on your purchase. Other 5% categories this quarter include electronics stores, utilities, gyms, department stores and fast food. The 2% categories include grocery stores, gas stations and restaurants.

5. Capital One SavorOne Rewards Card

If you like going out for dinner and entertainment, the Capital One SavorOne Card is excellent for year-round purchases. You can earn unlimited 3% cashback on all dining, grocery stores, tickets, and entertainment options like streaming services. The card also offers a $200 cash bonus if you spend $500 within the first three months. There’s no annual fee with this card.

Be aware that there’s an alternative card with a $95 annual fee that offers 4% on dining & entertainment as well as a higher cash bonus at the start. But you would need to spend an additional $9,500 on dining / entertainment per year just to cover the annual fee versus the 3% option.

Bonus: The Best Retailer Cards

As mentioned earlier, the best store cards are offered by Amazon and Target. Both retailers offer cards that offer 5% cashback without any cap on total purchases for the year. Popular cards include:

- Amazon Prime Rewards Visa Signature Card: 5% back on Whole Foods purchases, 2% back at restaurants / gas / drugstores, 1% back on everything else.

- Target RedCard: Free shipping on all Target.com purchases and additional 30 days for returning items. (Usually $40 off $40 coupon for signup)

- Lowe’s Advantage Card: Offers 5% cashback on all purchases. 6 months special financing on $299 or more purchases

- Costco Anywhere Visa Card: Offers 2% back on all Costco purchases, 4% back on gas, 3% back at restaurants