Here’s the Top 5 Credit Card Rewards for Q1 2021

While plenty of retailers have their own credit cards to earn a percentage back on a purchase or 0% interest for 6 to 12 months (along with astronomical interest rates if you don’t pay it off each month), many third party cards offer expanded options for rewards at your everyday retailers and other companies.

Here’s a collection of the top 5 cards you should be looking at as we move into the new year.

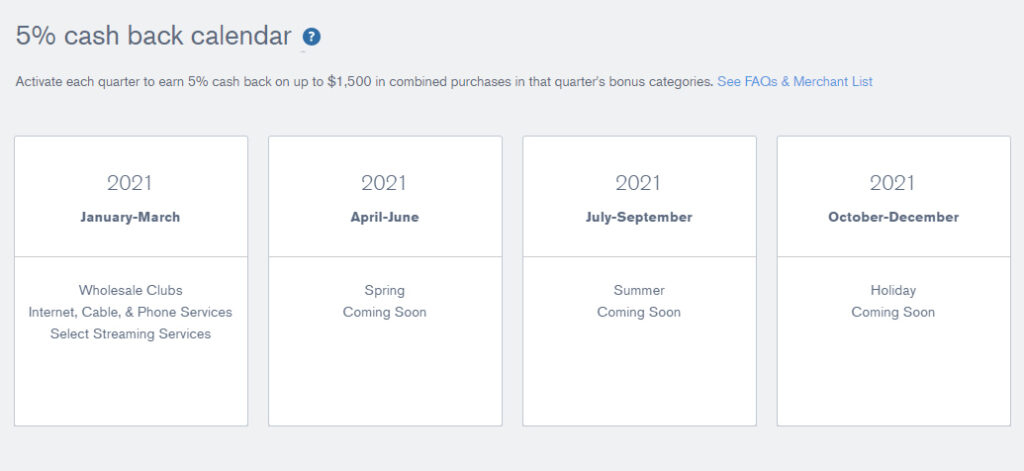

1. Chase Freedom

Between January 1, 2021 and March 31, 2021, the Chase Freedom card offers 5% back (up to $75 back on $1,500 in purchases) at wholesale clubs, companies that offer internet, cable and phone services as well as 12 streaming services.

The companies included in the wholesale clubs are Sam’s Club, CostCo, BJ’s and Texas Jasmine. Be aware that mobile services are also included in the second category. Pay your Verizon bill with the card and you will get 5% back this quarter. In addition, all the major cable & internet companies are covered in the offer.

Streaming services included this quarter are Apple Music, Disney+, ESPN+, Fubo TV, Hulu, Netflix, Pandora, SiriusXM, Sling, Spotify, Vudu, and YouTubeTV.

2. Discover it Cashback

Between January 1, 2021 and March 31, 2021, the Discover it Cashback card offers 5% back (up to $75 back on $1,500 in purchases) at grocery stores, Walgreens and CVS. While this isn’t as impressive as the 6% back on grocery purchases from the AMEX Blue Cash Preferred (mentioned below), it doesn’t have an annual fee (which the AMEX card requires).

Be aware that the grocery store category does not include superstores like Walmart or Target. It also doesn’t work at convenience stores, gas stations, warehouse clubs, or discount stores. So you don’t earn 5% cash back at places like Sam’s Club or a 99 Cents store.

3. Citi Dividend Card

Between January 1, 2021 and March 31, 2021, the Citi Dividend Card offers 5% back (up to $300 back on $6,000 in purchases) at Amazon as well as select streaming services.

Streaming services include Amazon Prime Video, Amazon Music, Apple Music, CBS All Access, Disney+, AT&T TV NOW, ESPN+, fuboTV, HBO Max, NBA League Pass, Netflix, Pandora, Showtime, Sling TV, Spotify, Starz, SiriusXM, Vudu, YouTube Red, YouTube TV, and Tidal.

Be aware that the $300 on $6,000 in purchases is specific to the calendar year. If you already earned $200 in rewards using the card during the first 9 months of the year, you would only be able to earn $100 back in the last 3 months.

Sadly, Citi has closed out the card for new signups, but existing users can still take advantage. Alternatively, the Citi Quicksilver card is offering 5% back at clothing stores, computer & electronic stores, department stores and toy stores this quarter. However, the offer is limited to a $25 credit ($500 in total purchases).

4. AMEX Blue Cash Preferred Card (Annual Fee Required)

Between January 1, 2021 and December 31, 2021, the American Express Blue Cash Preferred Card offers 6% Cash Back at U.S. supermarkets (up to $360 back on $6,000 in purchases) as well as 6% on streaming subscriptions & 3% on transit.

This card can be particularly useful for anyone with large families that spends quite a bit at the supermarket each month. It’s also good for the entire year (not specific to Q4), thus you can continue to save at the grocery store for 12 months.

The only downside is the $95 annual fee, but that’s easily mitigated with the $250 back on $1000 of purchases for new customers. If you don’t want the annual fee, you can step down to the Blue Cash Everyday card (which offers 3% back at grocery stores, same cap on total purchases).

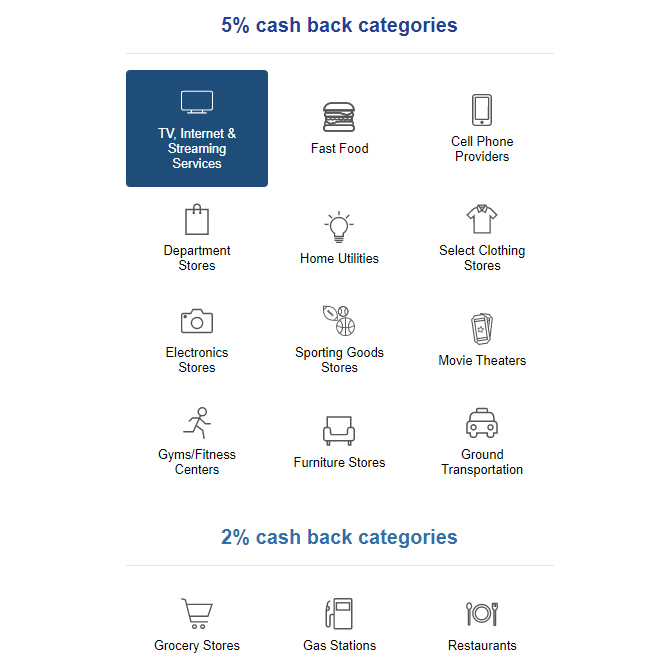

5. US Bank Cash Plus

The US Bank Cash Plus card is unique due to the fact that you can select the cashback categories that you want each quarter. After you sign up, you can select two different 5% cashback categories as well as one 2% cashback category.

For instance, if you know you want to buy a new couch soon, you can select the furniture store category to get 5% back on your purchase. Other 5% categories this quarter include electronics stores, utilities, gyms, department stores and fast food. The 2% categories include grocery stores, gas stations and restaurants.

Bonus: The Best Retailer Cards

As mentioned earlier, the best store cards are offered by Amazon and Target. Both retailers offer cards that offer 5% cashback without any cap on total purchases for the year. Popular cards include:

- Amazon Prime Rewards Visa Signature Card: 5% back on Whole Foods purchases, 2% back at restaurants / gas / drugstores, 1% back on everything else.

- Target RedCard: Free shipping on all Target.com purchases and additional 30 days for returning items.

- Lowe’s Advantage Card: Offers 5% cashback on all purchases. 6 months special financing on $299 or more purchases

- Costco Anywhere Visa Card: Offers 2% back on all Costco purchases, 4% back on gas, 3% back at restaurants