What Would You Rather Do Than Your Taxes?

Ever since the first tax filing day on January 31st, the tax season has been in full swing. For the next eight weeks, tax professionals will be hard at work digging through old receipts and looking for ways to increase your refund (or minimize your payments!). Of course, the average citizen is also accomplishing the same task with advanced tax software programs.

While taxes are often dreaded by many, we decided to conduct a survey to determine how dreaded taxes are compared to other uninspired activities. Collecting responses from 1,986 respondents, we’ve got some interesting data points explained below as well as a full infographic linked here. We have also included groups of helpful tips and links from tax experts to help you make tax time easier.

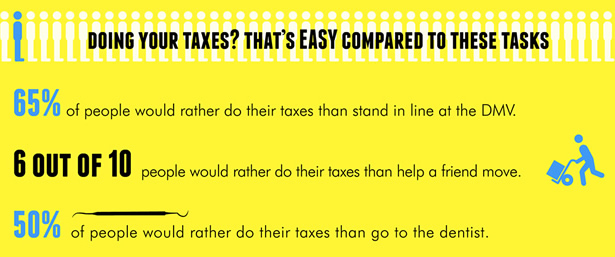

There are some things that are actually worse than taxes?!

Despite the stereotype that taxes are a grueling process that nobody likes, our survey data indicates that people actually prefer doing their taxes over heading into the DMV or helping a friend move.

Of course, there are a number of ways to make the process of doing taxes even less painful. For instance:

- Try expense tracking software: Offered up by ReadWriteWeb, start tracking your future expenses online using a site like Mint.com. When combining that with shifting away from using cash, you will have a vast record of all your costs and expenses for next year. This is especially ideal for anyone that needs to itemize expenses rather than take the standard deduction.

- Adjust Your Withholding: Detailed by CNBC, the IRS offers withholding calculators that allow you to see how changing your paycheck withholds will alter your tax liability for the next year. Some people prefer to see a big refund at tax time while others prefer to use that money gradually through the year. Withholding adjustments will help with this process.

- Use Tax Preparation Software: As as tax professionals will look for any potential issues within your tax forms, tax software will also check for errors as you progress through the program. Mentioned by Kiplinger, the software also checks for all possible deductions and credits in order to maximize your return.

But taxes certainly don’t beat everything

We also asked a collection of questions related to tasks that men and women stereotypically don’t enjoy. Surprisingly, taxes started to lose out when it came to tasks like having dinner with your in-laws or watching types of media like romantic comedies or sports.

Of course, there are many advantages to getting hitched when in regards to tax time. Perhaps these perks will help alleviate the stress of tax time and make it more delightful than sitting through hours of stifled conversation with your in-laws.

- Understand what marriage means for your taxes: Detailed by NBC’s TODAY, research shows that more citizens are likely to benefit from getting married rather than suffer from the much discussed Tax Penalty. You can find a Marriage Bonus and Penalty calculator at the Tax Policy Center in order to calculate your own future tax liability.

- Contribute to an IRA, even if you don’t have a job: As noted by Charles Schwab, a spouse that’s currently doesn’t have a part-time or full-time job can still have an IRA opened up in their name and funded by the other spouse. This is ideal for full-time moms or dads (which is a major job in of itself) and the tax benefits are wonderful.

- Investigate the benefits of filing jointly versus separately: Mentioned by U.S. NEWS, the obvious benefit to getting married is that only one joint return has to be filed as opposed to a return from each person in the marriage. While there are some situations were filing separately will provide a greater return, the joint return will be of greater benefit to the majority of Americans.

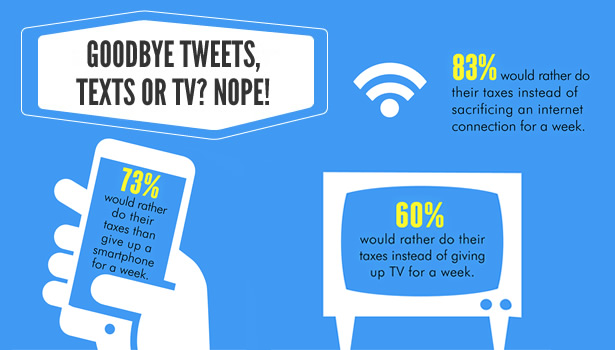

Take your hand off my smartphone now!

As time consuming as taxes can be each year, the majority of our survey respondents are not willing to lose connectivity to the world to escape those pesky 1040’s. In this scenario, we proposed that they simply wouldn’t have to do their taxes if they would give up different types of technology for just 7 days.

It’s obvious that consumers are addicted to their devices and their digital connection to the outside world. Of course, the combination of technology with taxes has led to increased simplification of the tax process for millions of Americans each year. The rise of computers led to tax software and the rise of the Internet led to e-filing. Technology even allows us to track the status of our refund online, which is much quicker due to the popularity of direct deposits. With that trend in mind, here are some tech tips for tax season:

- Apps! Apps! Apps!: Compiled by CreditCards.com, this collection of nine smartphone and tablets apps will help you knock out your taxes quicker. One of the more notable apps is IRS2GO, the official app for the IRS. It’s easy to pop into the app to check the status of your filing as well as track when your refund will be deposited.

- Try going paperless: Mentioned by CNBC, a service like Showbox will take all your paper receipts, scan them and send you the digital copies for a small fee. You can combine that with a digital file storage service like FileThis in order to save all those important docs in the cloud, just in case your hard drive at home is corrupted for any reason.

- Deduct Those Fancy New Gadgets!: Detailed on the TurboTax blog, technology like your computer, smartphone and Internet connection are deductible if you use them exclusively for business. This could even include the additional cost of Wi-Fi service on an airplane, assuming that you are working the entire time.

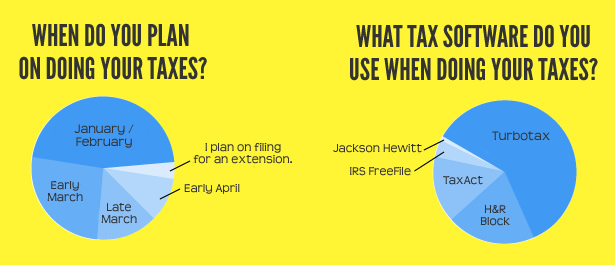

Time for Taxes

We also asked our survey takers questions related to timing as well as their preferred tax software. Interestingly, nearly half file before March even starts and more than 70 percent favor using tax preparation software over traditional filing.

If you are in the group that still hasn’t filed your taxes yet, be sure to check out our most recently posted deals on tax software below. You should also sign up for a Deal Alert to be notified the moment that the next tax software deal goes live.

Marissa

April 15, 2014 at 7:40 am

These are historical! Thanks so much for posting this! I’m lucky that my husband does the filing for our taxes. But this is still funny to me!